As Benjamin Franklin Said, “A penny saved is a penny earned” and his words of wisdom are still true after 200 years.

Our 26 week savings challenge allows you to put this wisdom into practice while still enjoying the journey.

Whether you’re saving for an emergency fund, a dream vacation, or for a purchase, the 6 month savings challenge can help you to reach your goals.

This savings challenge equips you with the knowledge and tools to make the most of this saving journey. Moreover we have discussed the benefits of the challenge, practical tips for success, and also the strategies to stay motivated along the way.

So let’s answer the first question you have in your mind!

What is the 26-Week Savings Challenge?

This bi-weekly saving challenge simply means saving a designated money every week for 26 weeks.

The 26-Week Savings Challenge is a simple & straightforward savings plan designed to help you stash a substantial amount of money over half a year.

Following an organized practice, you can slowly raise the amount you save each week, allowing you to start small and work up to more significant sums.

How to save money in 6 months?

This money savings challenge will start by saving $1 in the first week, then $4 in the second week & $7 in the third week, and so on.

You add 3 dollars each week to the previous week’s amount.

After 26 weeks, you have saved a total of $1001.

Also, if you’d wanna modify the challenge to suit your saving goal and want to increase the overall amount saved, you have the flexibility to do so.

Here’s How You Can Customize Six Months Savings Plan:

Determine your saving goal:

First, decide how much money you want to save within the six months. Let’s assume your goal is to save $2,000.

Define the number of weeks:

Next, calculate the number of weeks in six months. Since each month roughly consists of four weeks, you will have a total of 24 weeks in six months.

Distribute the savings:

Divide your saving goal by the number of weeks (24, in this case) to get the average amount you need to save each week. In this example, it would be $2,000 ÷ 24 = $83.33.

By saving $84 every week, you can have $2000 after six months. But saving the same amount is challenging.

Now Let’s customize the savings plan:

To create a modified savings plan that fits your savings goal, you can adjust the weekly savings amounts to gradually increase over time.

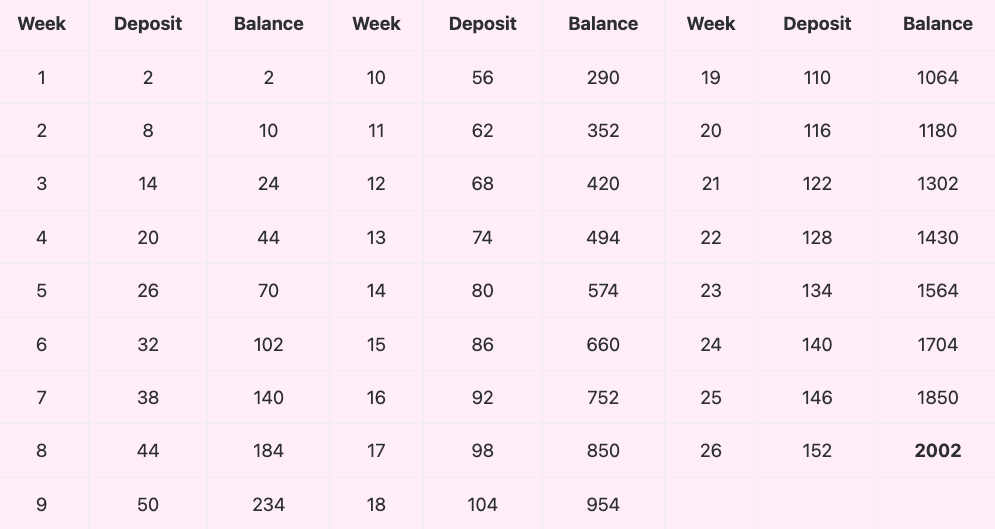

In this case, you can start with $2 and add $8 in the second week, and so on.

By adding $6 each week to the previous balance, After 26 weeks, you have saved a total of $2002.

Benefits of the 26-Week Savings Challenge:

Easy Start:

Jumpstart your savings journey with just $1 in the first week!

No matter your income or financial situation, this challenge is designed to be accessible to everyone. It’s like dipping your toes into the pool of saving without feeling overwhelmed.

Gradual Increase:

With the 26-Week Savings Challenge, you’ll gradually increase your savings each week. As the weeks pass, you’ll find yourself effortlessly adjusting your spending habits to accommodate the growing savings amounts, just like leveling up in a game, but with real-life rewards.

Tangible Progress:

Imagine watching your savings grow week by week. By the end of the 26 weeks, you’ll have a satisfying $1000 that can be used to tackle various financial goals.

Flexibility and Adaptability:

The 26-Week Savings Challenge isn’t set in stone. It’s adaptable. You can customize it to fit your needs.

Want to start with higher amounts? Go ahead! Prefer a longer-term savings goal?

Extend the challenge to 52 weeks!

This challenge bends and flexes to accommodate your unique circumstances.

Habit Formation:

Committing to this challenge means building a saving habit that will stick with you. By saving consistently over 26 weeks, you’re rewiring your brain to make saving second nature.

Tips for a Successful 6 Month Saving Challenge:

Track Your Progress:

Keep a record of your weekly savings using a budgeting app or on a printable 26 week challenge sheet. Research shows that tracking progress increases motivation & helps to stay accountable to your goals.

Seeing the numbers grow week by week provides a visual representation of your savings journey yet reinforces your commitment and encourages further savings efforts.

Automate Savings:

Why not set up an automatic transfer from your checking account to a designated savings account each week.

By automating your savings, you remove the reliance on willpower and reduce the temptation to spend the money earmarked for saving.

This method ensures consistency and makes saving effortless, increasing the likelihood of completing the 26-Week Savings Challenge.

Cut Back on Non-Essentials:

Take a close look at your expenses and identify areas where you can make minor adjustments.

For example, instead of buying expensive junk food, make a cheap grocery list where you list all the healthy foods that are cheap to buy.

These small and healthy life changes can add substantial savings over time. You’ll reach your goals easier by redirecting those funds toward your savings challenge.

Celebrate Milestones:

Recognize and reward yourself as you achieve milestones along the way.

Reaching mini-goals such as saving for five consecutive weeks or hitting the halfway point in the challenge is cause for celebration!

Treat yourself to something small, like a favorite dessert or a movie night, to acknowledge your progress & maintain enthusiasm throughout the six-month challenge.

The Bottom Line:

Start now your financial journey with the 26-Week Savings Challenge. Take the first step towards “Savings” today!

Most Viewed

Cheapest Grocery Store in 2024 – Save Big on Food and Groceries!

The Healthiest Foods under $48 to Add to your Cheap Grocery List Right Now!

10 Budget-Friendly Kids’ Favorite Foods for Picky Eaters

How to Stop Spending Money on Food for Healthier Living