If you’re one of the countless people striving to save money, you know the struggle of figuring out where to begin. The vast expanse of personal finance can be overwhelming, from budgeting to investment. Luckily, you don’t have to go it alone. With a plethora of financial education resources at your fingertips, like blogs, eBooks, and budget apps, you can take your first steps toward financial freedom. But with so many choices, finding the perfect book to meet your financial aspirations can seem impossible. That’s why we’ve done the work for you, compiling a list of the top ten books on saving money to get you started on your financial journey.

A penny saved is a penny earned

Benjamin Franklin

Check out some cool motivational quotes about saving money that’ll blow your mind!

These publications comprise a broad spectrum of topics, from fundamental personal finance basics to more complex investment strategies, endowing you with the knowledge and tools essential for effective money-saving, debt reduction, and wealth growth. These books on saving money serve as a compass, guiding you towards building a lucrative nest egg, planning for retirement, or establishing more sound financial practices, thereby providing valuable insights and guidance for attaining your financial goals.

10 Books on Saving Money You Should Not Miss

1. “The Millionaire Next Door” by Thomas J. Stanley

Are you looking to reignite your passion for saving? Look no further than this inspiring read! Author Thomas J. Stanley draws on interviews with hundreds of self-made millionaires to show how anyone can achieve financial wellness through smart saving and investing, regardless of their income level.

In this book, you’ll discover the secrets of millionaire success stories across the US. These are real people who’ve built their fortunes through years of disciplined saving and investing, not through lucky inheritances or family wealth. Stanley’s writing style is engaging and approachable, filled with relatable anecdotes and actionable advice that you’ll be eager to put into practice. Get ready to be inspired!

Achievements: One of the best personal finance books, it has a rating of 4.06 out of 5 stars on Goodreads based on 101,115 ratings and 4,310 reviews. It was also a New York Times bestseller for more than three years.

Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By Paperback – March 6, 2013

Save: $9.16 (48% Off)

2. Rich Dad Poor Dad by Robert Kiyosaki

Undoubtedly, Robert Kiyosaki’s “Rich Dad Poor Dad” is a ubiquitous name that has perpetually resonated for more than two decades, with a formidable reason. In this definitive tome, which ranks among the most sought-after personal finance books of all time, Kiyosaki expounds upon his experiences of growing up and learning from both his father and his friend’s father, the latter of whom is the “rich dad” in the title.

These lessons are a treasure trove of invaluable insights, covering topics such as how to accumulate wealth on a modest income, distinguishing between assets and liabilities, and exposing schools’ inadequacies in teaching children financial literacy. Notwithstanding the passage of time, the current 20th-anniversary edition, complemented with an update from the author, remains an indispensable compendium, illuminating all aspects of money, the economy, and investing, and unequivocally warrants its place on every avid reader’s bookshelf.

Achievements: Rich Dad Poor Dad has a rating of 4.7 out of 5 stars on Amazon and 4.12 out of 5 stars on Goodreads as of 2023. It is still the #1 Best Seller on Amazon in 2023.

Rich Dad Poor Dad: 20th Anniversary Edition: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

3. Why Didn’t They Teach Me This in School? By Cary Siegel

If you were to inquire about the critical topic that individuals wished they had learned more about in their formative years, the unequivocal answer would be money, or more specifically, the art of managing one’s finances astutely. Enter Cary Siegel’s opus, “Why Didn’t They Teach Me This in School?” The book, which comprises 99 principles and eight lessons pertaining to money, could have potentially been a staple in the high school or college syllabus, yet it remains largely overlooked.

The author, a retired business executive, initially wrote the book for his five children after realizing that the educational system had failed to equip them with essential personal finance principles before venturing into the world. However, the book evolved into an exceptional literary piece, lauded by numerous readers, and replete with priceless money lessons and Siegel’s experiential wisdom. The lucid and coherent writing style renders this book a facile read, making it ideal for fresh graduates or anyone embarking on their personal finance odyssey and intending to start off on the right foot.

Achievements: The GoodReads website has an average rating of 3.81 out of 5 based on 1,905 ratings. On Amazon, it has an average rating of 4.4 out of 5 based on 1,428 ratings. The book has not won any awards or achieved any best-selling status. However, it is available in various formats such as Kindle, paperback, and audiobook.

Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By Paperback – March 6, 2013

Save: $1.32 (9%Off)

4. Broke Millennial: Stop Scraping By and Have Your Financial Life Together by Erin Lowry

Is it not the ubiquitous ambition of every millennial to achieve financial stability? If you belong to a group of individuals aged between 20 and 30 and yearn for the power to steer your finances with confidence, then this book is unequivocally tailored for you.

Authored by Lowry, this book delivers a convivial and easily digestible elucidation of personal finance, making it particularly suited for those who find the world of economics a tad intimidating. Although it may not be a comprehensive guide to complex tax strategies or sophisticated retirement planning, it certainly serves as a fantastic initiation to the fundamentals. Armed with the knowledge gained from this invaluable resource, you may be well on your way to kick-starting your savings game and perhaps even an inch closer to achieving your long-term financial goals.

Achievements: The book has a rating of 3.91 out of 5 stars on Goodreads, based on 4,631 ratings and 552 reviews. MarketWatch named it one of the best money books of 2017.

Broke Millennial: Stop Scraping By and Get Your Financial Life Together (Broke Millennial Series) Paperback – May 2, 2017

Save: $1.60 (10% Off)

5. “But First, Save 10: The One Simple Money Move That Will Change Your Life” by Sarah Catherine-Gutierrez

This literary work elucidates the foundational precepts that underlie the “pay yourself first” financial strategy. It is a revolutionary concept that mandates saving and investing a specific proportion of your earnings prior to indulging in other discretionary expenditures. Through a comprehensive walkthrough, this book expounds on the nuts and bolts of establishing an emergency fund, planning for retirement, and saving up for other exciting future purchases.

Notably, the author is a seasoned financial planner, imbuing the book with a palpable sense of authenticity, credibility, and expert insight. Indeed, this literary masterpiece serves as an excellent motivational resource for anyone seeking to scale back their spending, amass their savings, and reach their goals through time-tested and straightforward financial strategies.

Achievements: On Amazon, it has an average rating of 4.8 out of 5 based on 68 ratings. On Goodreads, it has an average rating of 4.41 out of 5 based on 10 ratings.

But First, Save 10: The One Simple Money Move That Will Change Your Life Paperback – Illustrated, July 22, 2020

6. Kakeibo: The Japanese Art of Saving Money by Fumiko Chiba

In the realm of budgeting, there is a new contender for your attention, and it comes all the way from Japan. The book “Kakeibo: The Japanese Art of Saving Money” is a refreshing take on budgeting, which shares a similar philosophy with Marie Kondo’s minimalist approach. The author, Fumiko Chiba, introduces the Kakeibo method, a hundred-year-old practice of tracking expenses in the home.

One of the best books on saving money, it goes beyond traditional budgeting, making saving an integral part of your daily routine. Chiba’s book offers pages to fill out daily, as well as a comprehensive introduction to the Kakeibo method. It’s the perfect read for anyone looking to add cultural diversity to their budgeting strategy while improving their financial habits.

Achievements: The book has a rating of 3.62 out of 5 stars on Goodreads, based on 172 ratings and 35 reviews.

Kakeibo: The Japanese Art of Saving Money Paperback – Illustrated, November 6, 2018

7. Clever Girl Finance – Ditch Debt, Save Money, and Build Real Wealth By Bola Sokunbi

Breaking news: The gender pay gap persists, with women earning only $0.82 for every dollar that men make, according to the U.S. Department of Labor. The gap widens even further for moms, with them earning a mere $0.71 for every dollar that fathers make. Talk about an uphill battle! But fear not; Bola Sokunbi’s “Clever Girl Finance” book is here to level the playing field. As a Certified Financial Education Instructor (CFEI) and founder and CEO of Clever Girl Finance, Sokunbi is on a mission to empower a new generation of women to take control of their financial futures. Her book covers everything from budgeting and expense tracking to credit management and retirement planning. With Sokunbi as your guide, you’ll be a financial force to be reckoned with in no time.

Achievements: The book has a rating of 3.82 out of 5 stars on Goodreads, based on 975 ratings and 92 reviews.

Clever Girl Finance: Ditch debt, save money and build real wealth Paperback – June 25, 2019

Save: $8.36 (34% Off)

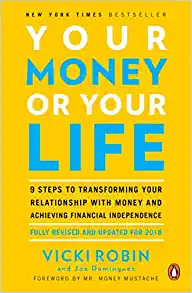

8. Your Money or Your Life By Vicki Robin

Have you ever experienced like your money is controlling your life? Vicki Robin’s “Your Money or Your Life” has sold over a million copies for a reason! It’s a step-by-step guide that’ll help you transform your money mindset so you’re not a slave to it anymore. This book will guide you on how to get out of debt, start investing, build wealth, and even save money by practicing Robin’s unique mindfulness technique. So, if you want to be in control of your finances and live a fulfilling life, this read has got your back!

Achievements: This book by Vicki Robin and Joe Dominguez has a current rating of 4.5 out of 5 stars on Amazon UK, based on 4,010 global ratings.

Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Fully Revised and Updated for 2018 Paperback – December 10, 2008

Save: $5.21 (29% Off)

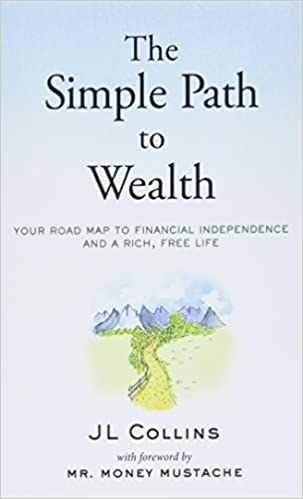

9. The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life, by JL Collins

Are you tired of drowning in financial jargon? Fear not, for JL Collins’ “The Simple Path to Wealth” is here to simplify investing for the masses. Originally written as letters to his daughter, this book is an accessible and practical guide to achieving financial independence through sound investment strategies. Collins’s writing style is light and engaging, making complex financial concepts easy to understand for everyone.

Achievements: The proof is in the pudding, as this book boasts over 3,800 reviews on Amazon, with an average rating of 4.8 stars. The book also has a rating of 4.45 out of 5 stars on Goodreads, based on 18,479 ratings and 1,616 reviews. Take advantage of the opportunity to learn from the best!

The Simple Path to Wealth: Your road map to financial independence and a rich, free life Paperback – June 18, 2016

Save: $2.00 (10% Off)

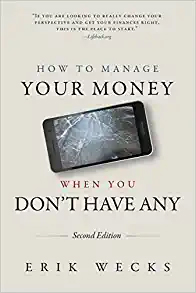

10. How to Manage Your Money When You Don’t Have Any” by Erik Wecks

Erik Wecks’ book isn’t just about money. It’s a guide for navigating through the rough economy of today. And if you’re someone who lives paycheck to paycheck, this book will be a godsend. With Wecks’ guidance, you’ll be able to think about money in a whole new way. By the time you finish reading, you’ll know exactly what your priorities are and what’s worth spending your hard-earned money on. Get ready to break out of that financial rut and start taking control of your finances!

Achievements: One of the best books about saving, it has a rating of 3.82 out of 5 stars on Goodreads based on 1513 ratings and 190 reviews.

How to Manage Your Money When You Don’t Have Any Paperback – June 7, 2012

Final Verdict

Who says money talk has to be boring? The personal finance genre is awash with a treasure trove of books on saving money, each offering a unique perspective on achieving financial success. From the classic “Rich Dad Poor Dad” to the more recent “The Simple Path to Wealth,” these books on saving money provide actionable advice for you to gain greater control over your finances. By investing time and effort into these resources, you can manage your money more effectively and achieve your financial goals. So, whether you’re looking to build wealth or get out of debt, there’s a perfect book out there that will set you on your path to financial success!

Most Viewed

Cheapest Grocery Store in 2024 – Save Big on Food and Groceries!

The Healthiest Foods under $48 to Add to your Cheap Grocery List Right Now!

10 Budget-Friendly Kids’ Favorite Foods for Picky Eaters

How to Stop Spending Money on Food for Healthier Living